Is Purplebricks in trouble? Probably

Purplebricks Background

Established in 2014 Purplebricks was considered a disruptor in the estate agency business. Traditionally estate agents have shop fronts on streets close to you and they have staff there to manage the sale of a property as well as other services. A very personal, face-to-face type of business.

Being entirely online you may see for sale signs with Purplebricks on them, however, you won't see their stores anywhere as they have none. They are entirely online dealing with all property from a central office with all communication done by phone or email.

Properties are marketed online, through their website and portals such as Rightmove, nowhere else. The traditional method for estate agents is to charge a commission on the sale price of the property, say 2% with a minimum of £1k. Purplebricks charges a fixed fee of £1,499 within London and £999 in all other locations.

instead of having someone in an office locally to assist in selling your home, they will put a seller in touch with an agent, someone considered experienced in estate agency, a property expert. They will handle the tasks the traditional estate would. Preparing a property schedule, images and so on whilst the Purplebricks head office will deal with putting it all together, marketing, offers and anything else required.

There is more to it of course, but it sets the basic idea of what they do.

2021 financials

Full-year accounts were recently released and as expected things were not looking great. Some highlights.

- Revenue was down from £90m to £70m.

- Gross profit also down, £57m to £42m.

- Overall losses are £42m from a profit of £6.8m in 2021.

- Cash reserves are £43.2m, down from £74m in 2021.

Changes to their operating model and investment in marketing that did not deliver as expected along with market conditions were cited as reasons for the poor performance. Now they are focussing on cost reduction, retraining and other initiatives to turn the business around.

Ultimately if they don't make changes quickly and continue on the same trajectory they have enough cash in the bank to last about 18 months.

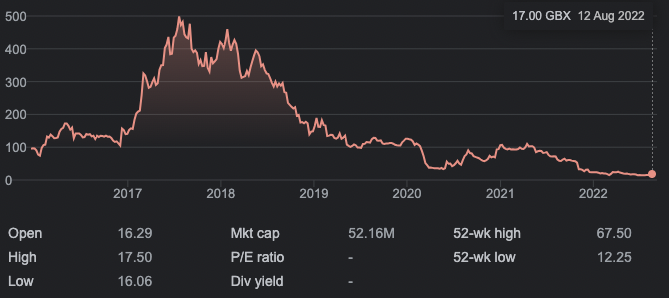

They have what is called an 'activist investor'. Adam Smith owns 4% of the business and is calling for Chairman Paul Pinder to be dismissed. Purplebricks' share price has dropped to an all-time low. This could make then a takeover target.

Where have Purplebricks gone wrong?

Self-employed agents at the firm, the ones that work with vendors locally claim they are in fact employed and entitled to holiday pay and pension contributions. A class action case is being considered. Ultimately using self-employed agents is a cheaper approach, but. They have since moved to a fully employed status for all local agents which is a significant cost increase.

Their net margins are slim, very slim. Suggested at 7% much of this related to their very automated approach. But the additional cost of having all of their local agents employed is going to hit that net margin hard. Hence the summary comment of this article is that they are not charging enough or the right way.

There have been complaints about their advertising. A number of resignations and unconfirmed dismissals of high-profile employees. Customer service standards have come under scrutiny and the firm itself confirms it has to do better. They were named the UK's worst performing for customer service recently.

Analyst opinion suggests a return to profitability is not anticipated within the next 3 years. They need further and significant investment in their technology. How will they achieve that whilst announcing plans to continue cutting headcount and costs?

Whilst they do have a new fee structure, many still suggest it is not enough, that is, high enough. Purplebricks are not the first to come up with a low-fee, tech-led approach to estate agency. Most have failed or been bought out by a more traditional firm. It feels like Purplebricks are only now starting to understand their model doesn't pay despite some success.

The list goes on so I won't dwell more on the reasons other than to say there are many and more reasons why they are struggling.

Not going to dwell on their issues, there are more but you get the idea.

Should you be worried?

As a customer that is or intends to use Purplebricks, there is nothing to worry about right now in terms of them going out of business. They are still out there in the market, trying new things and have the means to continue, for a while.

Having said that it is difficult to ignore recent events such as being voted worst for customer service. This is a key area you expect any firm charging a fee to at least be competent.

It is an interesting company to watch and see how things develop. If anything particular or major develops I will be sure to update.

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

Pladda Island for saleOlder Post >>

0.5% Increase to interest rate