House prices continue to fall in 2023

It should come as no surprise to most that property prices are falling. After the disastrous mini budget last year, the increasing interest rates and inflation, the housing market had begun to change. The UK housing market is quite resilient and it takes some time for it to change direction, but here we are.

Mortgage approvals are down by around 30% since November 2023 as fewer look to buy a 1st home or move to a different one. That said the number of actual mortgage completions is fairly strong of late, however, the mortgage process isn't the fastest. So it is likely we are still seeing completions where the process had started before the mini-budget meant when very low rates were still available.

The outlook as we get into 2023 is that both mortgage approvals and completions will be lower than historically seen and that will remain the position through 2023, unless inflation and rates swiftly come down. There is no current prospect of that happening.

Halifax House Price Index (HHPI)

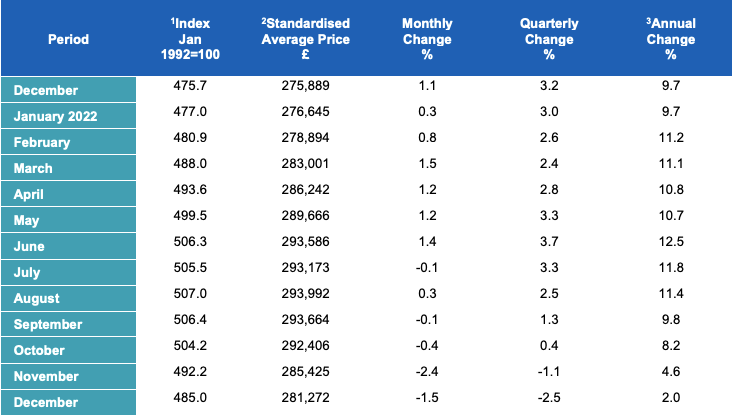

HHPI is the longest running house price index, it has provided data on the entire UK housing market since the early 1980s. It gives us a good view of what is happening in the market month to month. Highlights courtesy of the Halifax:

The highlights are that everything is down. The average house price is down 1.5% in a single month, down 2.5% over Q4 of 2022 but still slightly above where it was at the end of 2021. The table below shows the changes since December 2021 with the decline being seen from Sept 2021.

The reasons are clear as to why this is happening or maybe they are not depending on how much interest you have in the market. I get lots of questions about it. Why is it happening? How will I be affected? Will I be affected? I will try answer some of those questions.

Why are house prices falling?

It's ultimately all about supply and demand. When there are enough people wanting to buy in the market it keeps prices mostly steady or slowly increasing. If there are more than enough buying, that creates competition for homes so it pushes prices upwards more quickly. But you can also have the position we are in today where those who were or currently are contemplating selling are less eager. Prices are coming down, they don't want to lose money.

In the current market there are a number of factors that are resulting in less demand and less competition. Where there are fewer buyers in the market it allows opportunity for them to pay less for a property because they are the only one bidding just in the same way they would need to pay more when many are bidding.

But that is not the only part of the story. With rising mortgage rates the payments are getting higher, less are able to afford the higher payments as a result of rising interest rates. But we also have inflation, general living costs such as energy bills are increasing by no small amount and squeezing affordability even more.

So what is the result? House prices need to fall and will continue to fall until people start buying, or more people start buying because the price is affordable for them in the current economic position.

Who are the winners and losers?

There are always winners and losers in the property market whatever condition it is in. Sometimes it is those buying and other times it those selling. Today it would be reasonable to say:

- The market is good for buyers and will get better as prices fall further. There is more opportunity for them to pay less.

- The market is not so good for those selling when prices are coming down. The average house price in August last year was around £294k, in December it was down to £280k. A £14k loss is a lot for many that it may cause them to think again about selling. Of course the loss could be greater depending on the area and property.

- If homeowners are not selling then supply suffers. Whilst that can increase prices due to the lack of supply, the demand is still going down due to interest rates, inflation and so on. So this helps nobody.

It's complex though, nothing in our economy is that easy to explain without a lot more detail but you get the general idea.

What is the outlook for 2023?

Everyone in the market who produces house price data or opinions we trust all say the same thing. House prices will keep going down for now. The general consensus is prices will fall around 10% in 2023.

A lot is going to depend on interest rates, when will they peak? When will inflation stabilise? Time will tell.

However the market changes over the next few months, I will be here to update.

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

Private island of Vaila for sale at £1.75mOlder Post >>

Open Market Shared Equity Scheme