What is Fiscal Drag and how does it affect you?

Fiscal drag is not a subject that easily comes along in general conversation. Thanks to recent high inflation, though, it's much more apparent, and people are noticing it. When discussing how thankful a friend was that his employer had increased his salary by 10% in the last two years due to high inflation, he realised that he was, in fact, not benefitting as much as he thought. Why?

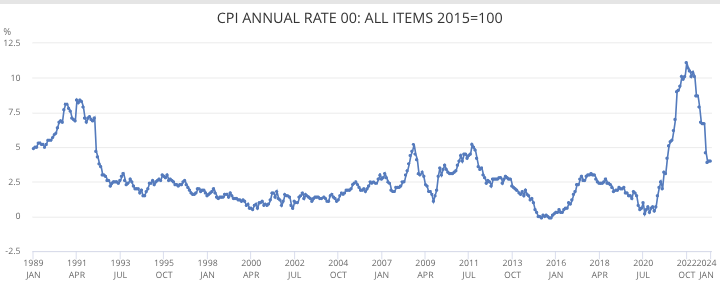

Inflation

In normal times, the UK has a 2% inflation target each year, and for many years before 2021, it hovered in that range, sometimes lower, occasionally a bit higher. As we can see from 2021 onwards, it started to rise. CPI peaked at 10.1%.

What does this mean in general terms? The cost of goods and services is rising faster than expected. As a result, our current salaries are worth less than before, meaning we have less buying power. Therefore, we expect our wages to increase with the inflation rate so that our buying power remains unchanged. For many, that did happen. Not everyone was that fortunate, of course.

To put that into a simple example

I earn £20,000 gross annually, and inflation rises 10% yearly. In simple terms, that could mean that in the following year, I will still get £20,000 without a pay raise, but due to rising costs of goods and services, everything costs about 10% more. Without a raise, my wages would be worth 10% less due to inflation, about £18,000. In effect, my wages are worth less than last year, even though I get paid the same amount.

Given the above, I would like my wages to rise by 10% to £22,000 to match inflation. Even though my wages have gone up, All I am achieving is earning more to cover the exact costs as last year. I am not getting an extra £2k that could be considered 'spare cash'.

Sometimes, people pay no tax because they are under the threshold due to personal allowances. However, they may now be paying taxes.

What is Fiscal Drag?

Now, Fiscal Drag comes in. It's easier to understand than the term may imply. Fiscal drag is an economic concept that occurs when high inflation and income growth co-occur, which is exactly what many are experiencing now.

In my friend's example, he works in engineering and received an 8.4% wage increase last year and a 2.1% increase this year; let's call it 10% overall. That's good right? Well, yes. But there is a catch.

Two key elements can occur when inflation and wage growth are at high levels. My friend got caught in both.

Tax Rise

It should be no surprise that your wages increase, and so does your tax. But there is a second potential issue. When you get a higher-than-usual rise, as many have up to 10% in recent times, it may also cause you to move into the next higher tax bracket.

And that is precisely what has happened to my friend and many others, for example.

- In Scotland, if you earn £26,000 and get a 10% rise of £2,600, most of that rise will result in 21% tax being paid instead of 20%. Worse, if you earn about £43,000 and get a 10% rise of £4,300, then you will pay tax at 42% on the majority of your rise instead of 21%.

- In England, earning around £37,000 with a 10% rise of £3,700, most of that rise will end up in the 40% tax bracket instead of 20%.

Of course, these are worst-case scenarios; some may only fall into the next tax bracket, so the effect is more minimal.

Ultimately, when you consider everyone that this happens to, it generates higher than anticipated income tax receipts for the government. It's like the government has increased income tax without actually doing it.

Loss of other benefits

There are other consequences to receiving high increases in wages. One example:

- You may lose or see some personal allowances reduced if you are now in a higher tax bracket. For example, you may not pay tax on the first £1,000 of savings today, but if your raise sees you move into a higher tax bracket, that will reduce to £500, resulting in more tax being paid on your savings.

Again, this means that the government collects more income tax from your wages due to receiving more and moving into a higher tax bracket and more tax from the reduction in personal allowances across a broad range of circumstances.

Fiscal drag: You're being dragged into paying tax or more tax due to the combination of inflation and wage growth without the government doing anything to raise taxes.

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

Mortgage arrears hit 7 year high!Older Post >>

Budget 2024 - Stamp Duty - Non Dom Status