What happened to the mortgage affordability stress test?

First things first, what actually happened and why? Did you even know there was a stress test?

What is the stress test?

Since 2014 lenders were required to stress test mortgage lending. For example, if you took out a mortgage the regulator stated that lenders should add 3% to the revert rate of the mortgage, this was to establish if there was a payment shock due to rising rates, the customer could still afford the monthly payments. If they couldn't, either no mortgage was made available or it had to be reduced until affordability could be met.

What is the revert rate you ask? Say you took out a mortgage at a fixed rate of 2.5% for 2 years. The mortgage offer has to state what the lender's rate is after the 2-year fixed rate ends. It's difficult to know what that could be in 2 years so they use the standard variable rate as it stands today. If that is 5% then lenders need to add 3% to it o create a rate of 8%. Affordability is then tested at 8%. If the client can afford the mortgage should it rise that high they can get the mortgage.

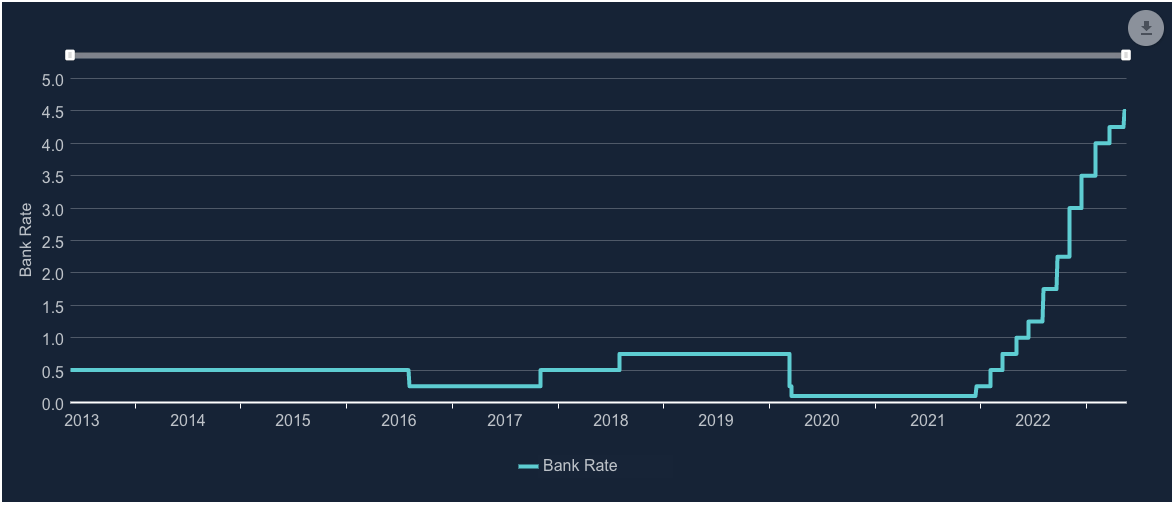

There was much opposition to this test, especially given the historically long low rates we have seen for such a long time. Looking back at the last 2 years it does appear to have been a prudent test.

Why was it scrapped?

The Financial Policy Committee (FPC) decided that from the 1st of August 2022, the Affordability stress test was no longer recommended. I won't spend too much time on this as it's likely not that interesting to most readers. Suffice it to say that the FPC felt it was no longer required. There are many requirements on lenders to assess affordability and none of these are changing.

Particular focus was placed on Loan to Income (LTI). There are flow limits on this which the FPC felt are adequate on their own without adding a stress test. Lenders are required to limit the number of mortgages they provide to 4.5x LTI, mostly. Lenders can go above this but it should be no more than 15% of their lending over a rolling 4-quarter period.

LTI existed long before stress tests. Simply put it limits how much you can borrow relative to your income. So if you earn £50,000 per year, your borrowing would be limited to £225,000. Not that simple of course. There are many other affordability requirements which must be met. LTI simply sets a maximum level of borrowing.

So why are lenders still using a stress test if it was scrapped?

The first point is that the removal of the stress test is a recommendation only. Lenders can continue to use it if they choose. The next important consideration comes down to timing. COVID happened then the disastrous leadership of Liz Truss sent interest rates out of control.

It should therefore come as no surprise that lenders didn't feel that an appropriate response to this was to remove the stress test. I know of no high street lenders at the time of writing that has removed the stress test. In time they will but not whilst we see so much turbulence in the markets.

Some lenders are reducing the stress rate

The rules as noted above before the stress test was scrapped were to add 3% to the revert rate. With the removal of the Stress test, it does mean that lenders who continue to use it can decide for themselves what the stress should be. One lender I know has reduced it to 2% for example.

Before you go looking be assured that lenders will not openly advertise how they apply the stress test.

Assume the worst!

For now, assume that lenders have changed nothing and the stress test is being applied as it always was.

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

Older Post >>

Interest Rates Rise to 4.5%