Understanding an SPV

SPV is an acronym for Special Purpose Vehicle. There are a number of reasons someone would want to hold property in an SPV and we will look at that and more in this short guide.

What is an SPV?

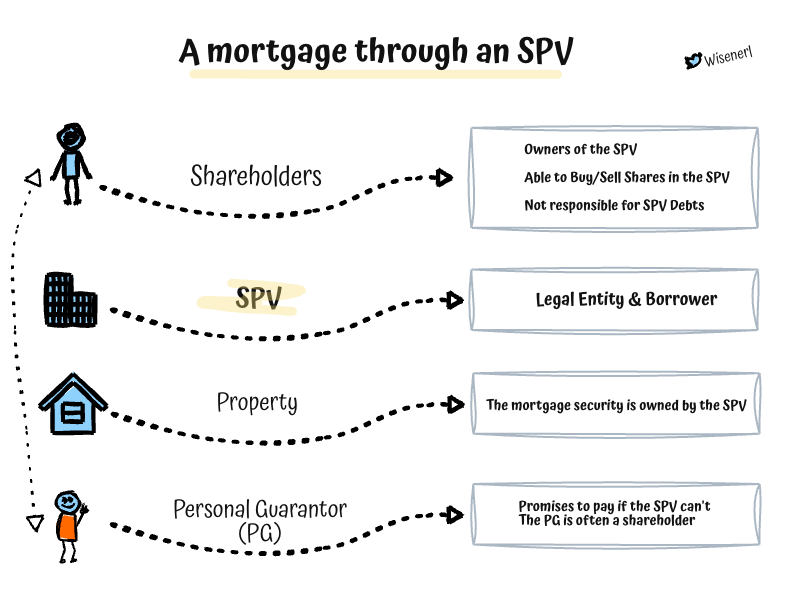

A Special Purpose Vehicle is a limited company, it can be called anything providing the name has not already been taken. Take a look at the chart below that I have put together to make the structure clear.

Shareholders

The shareholders of the business are responsible for running it and ensuring it meets all of its obligations. Whilst the shareholders are not liable for the debts held in the SPV they can be held liable for any decisions they make as they would in any other business.

The shareholders may be entirely independent of those who will reside in the property or they may be the same.

The SPV

As the SPV is a limited company, it is treated like all limited companies, a business. A legal entity in its own right.

The Property

The property is the reason for the SPV, it will hold the property as an asset, it is the legal owner of the property.

Why use an SPV?

There are many reasons someone would prefer to place a property in an SPV. Some are listed below.

- For Buy To Let properties there are tax benefits in holding the properties in an SPV.

- For residential properties, there may be other tax or IHT benefits to placing the property in an SPV.

- Privacy, some high profile individuals may not want others to know they own a property.

Who is the UBO?

A term you may hear referred to is the UBO. This is the Ultimate Beneficial Owner. For example, in the case of the privacy of a high profile individual who does not want others to know the property belongs to them is the UBO. The person who ultimately owns the property.

The SPV has been set up to protect them from being connected legally to the property. This does not mean they are hiding something illegal. In the past, I have seen situations where organized crime has used the land registry to find out who owns certain properties. Knowing that a particular person owns the property may lead to planning a burglary on the assumption there may be specific valuables based on who lives there.

There are many reasons to use an SPV, for those that work in the industry and are presented with a case of this type, the reason should be clearly explained.

Personal Guarantee

Often, the SPV is set up for no other reason than to hold the asset, the property. It does not generate any income as the property will be used as a home for the UBO. In this case and given the legal owner of the property is the SPV then it could not demonstrate an ability to meet the mortgage payments.

In this case, a Personal Guarantee or PG will likely be required and this will come from the UBO. The UBO will guarantee the mortgage payments as it is ultimately their income/wealth from which the payments will come. The lender will satisfy themselves that the UBO could support the mortgage as required.

The UBO will be ok with this, in the case of privacy, only the lender knows they are providing the PG, this is not information that will be shared with the land registry for example.

In the case of an SPV being used for BTL properties then it is likely to be generating income in the form of rent. Any tenants will have a tenancy agreement between them and the landlord (SPV) and will make rental payments to the SPV.

And those are the key elements of an SPV. There are more complex structures that can be used for a mortgage and I will look at these also in future guides.

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

From Power to PenthouseOlder Post >>

Damage From Trees