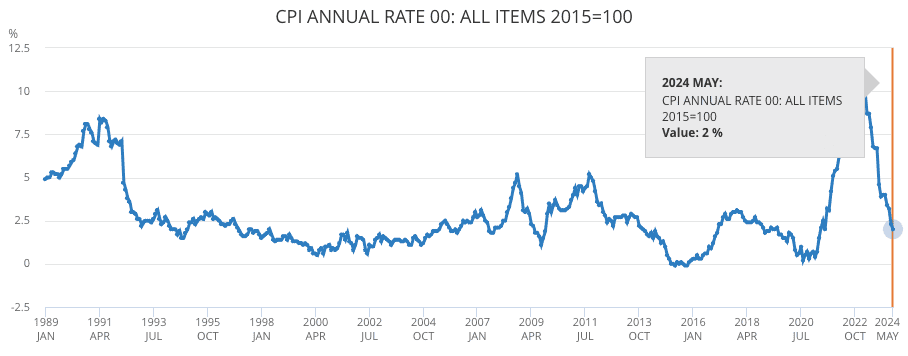

Inflation falls to 2%, will interest rates follow?

As of May 2024, inflation has fallen back to the Bank of England target of 2%. This is expected but still good news. UK inflation is now below the US and Europe. July 2021 was the last time inflation was at or below 2%.

From the Office of National Statistics

Will we see a cut in interest rates?

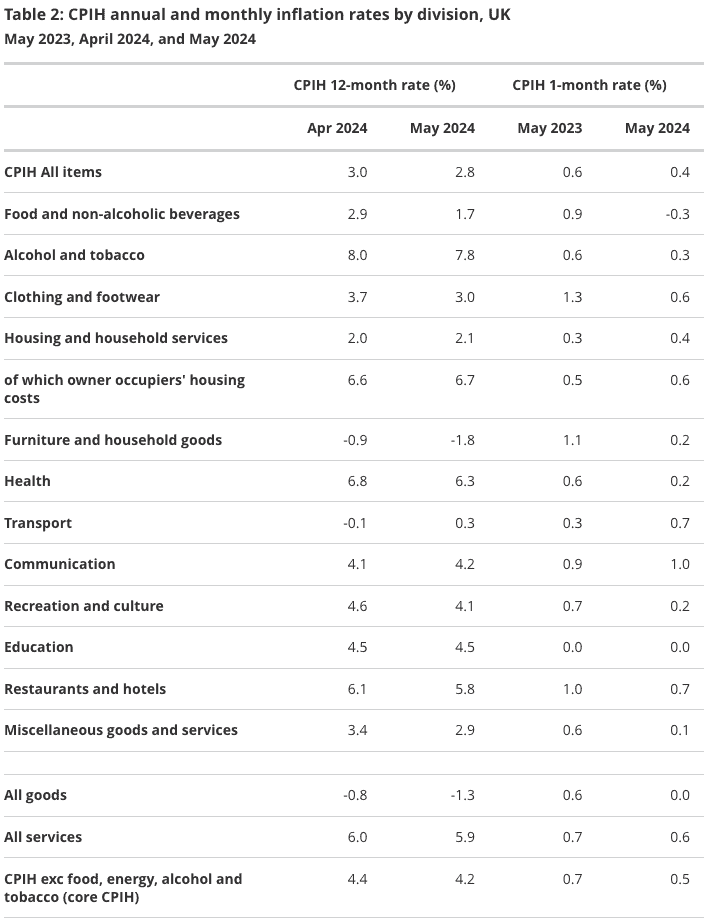

You would think so, right? But one thing that has spooked analysts is that while inflation is in a good place, the cost of services rose higher than expected. This includes housing costs, transport and communications. Why does this matter? Well, ultimately, it means that whilst inflation is down, some areas are rising, which suggests inflation is not entirely under control. The table below shows the main areas and movements from last month and last year.

Based on this information, analysts are still wary of betting on a base rate reduction of 0.25% when the Monetary Policy Committee meets tomorrow, 20.06.2024.

For reference, at the last meeting of the Monetary Policy Committee, there were 7 voted to hold and 2 voted to reduce. Not really a feeling of positive steps towards a reduction. That said there is a lot of pressure on the Bank of England right now to give us

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

New Tax GuidesOlder Post >>

Inflation on the rise again