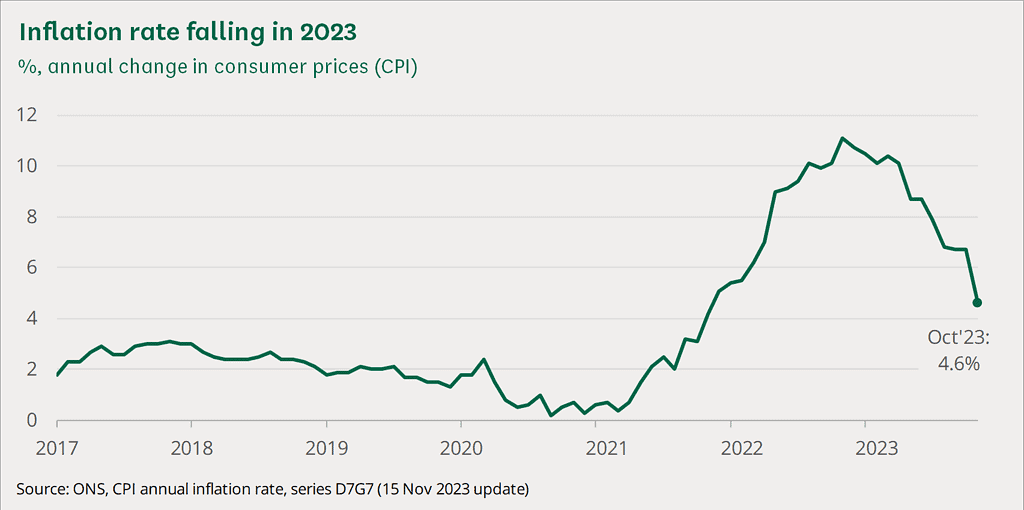

Inflation falls sharply to 4.6%

Rishi Sunak was quick to come out punching the air saying he promised in January to half inflation and that is exactly what he has done. Let's not spend to much time picking holes in who did it other than to say it's more complicated than that.

A decent drop

It's good news though, from 6.7% in September to 4.6% now. Slightly better than analysts had predicted at 4.8%.

There is a downside though. Prices are still rising, about twice as fast as the Bank of England target. Also not great that the economy is fairly static, not dropping but not growing.

Mortgage Rates

What we are interested in on this site is what it means for Mortgage rates. Unfortunately not a great deal. Well, the positive is that we can be fairly confident that interest rates have peaked. There is no reason for the Bank of England to increase mortgage rates any further.

On the negative, the Bank of England won't be rushing to drop interest rates.

Analysts have varying views, the most popular theories are that rates will fall to around 3% by the end of 2025 say Capital Economics. Morgan Stanley suggests cuts will come as soon as May 2024 and fall to 4.25% by the end of 2024.

This all assumes inflation continues to behave and all other possible spanners that could be thrown into the works stay on the shelf out of the way. Time will tell. But we are in

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

Affordability test for a BTL?Older Post >>

Mortgage Underwriter – a role for you?