Cost of renting in Scotland increasing faster than London

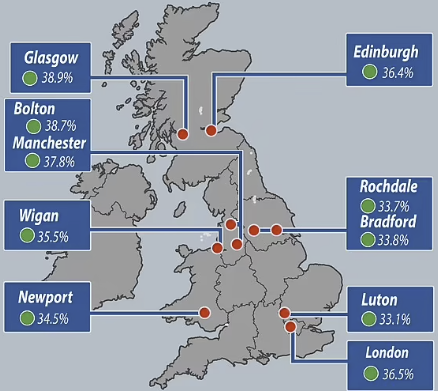

Looking at rental costs over three years (2020-2023), renting in Glasgow has increased by 38.9%, the highest increase across the UK. Edinburgh has come in 4th highest with a rise of 36.4%. The graphic below shows the increases seen across the UK.

Increase Cost & Changes in working patterns

The increased cost of borrowing due to higher interest rates is a clear and obvious reason why rents are increasing but that is not all.

The reason for some of this increase is connected to working patterns. With many now working from home, there is less reliance on the need to be in cities. Even for those who go into the office a couple of days each week, it's more manageable that many do not choose to rent further outside of cities. That allows them to rent more significant properties, which has benefits over the smaller city flats they may have had. However, that increases the demand on areas that hadnt seen it before and therefore pushes up asking rents.

The competition for property in areas with good transport links with cities has increased substantially. Agents report multiple offers on virtually every property, increasing prices, and tenants are still willing to pay. Agents in some areas struggle to provide properties to meet demand, especially in those out-of-city areas with good transport back into them.

Demand remains high

While many workers choose to move further away from a city, demand remains high in the cities. With students returning after COVID, a reasonably strong job market and immigration all keeping up the pressure.

Rising house prices and mortgage costs add to the pressure as people cannot purchase a home. With higher rents the struggle of rental costs means less ability to save for a deposit to buy a house and many feel that by the time they do save enough property prices have moved up again and they get into a circle of saving but never having enough to get on the property ladder.

Supply remains an issue

As I have reported previously, supply is a significant issue. Private landlords have left or are leaving the sector. Those landlords with a property portfolio are not taking on any more now. This is driven by new rules and regulations coupled with higher interest rates.

Figures suggest that the number of rented homes has changed very little since 2016. Supply is not keeping pace with demand.

Property website Rightmove has suggested that there has been an average of 15 enquiries for every property coming to market. Whilst that is down from 20 a year ago, it indicates the supply struggle.

Landlords critical of the view towards them

Landlords have hit back at criticism towards them. They highlight that the cost increase is not just about increasing their profit. Most landlords have mortgages; they must deal with the increased cost of borrowing, which must be passed on to the tenant.

They also highlight that the general maintenance cost has increased significantly since the pandemic. One landlord highlighted that an identical repair which cost them £125 three years ago now costs £205. Material costs have risen sharply, as has the cost of labour.

Many private landlords again point out that they are not charities but investing in their future, not the tenants. Being a landlord is much less attractive these days, and many are no longer growing their portfolios or leaving the market altogether.

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

Budget 2024 - Stamp Duty - Multiple Dwelling ReliefOlder Post >>

Are interest only mortgages still a reasonable option?