Scottish Income Tax Changes in April 2024

From April 2024 the SNP will introduce an update to the income tax bands which will impact many workers. The table below shows the changes that will come into force from April 6th 2024.

| Band | Rate | 2022/23 | 2023/24 |

|---|---|---|---|

| Personal Allowance | 0% | Up to £12,570 | Up to £12,570 |

| Starter Rate | 19% | £12,571 - £14,732 | £12,571 - £14,876 |

| Basic Rate | 20% | £14,373 - £25,688 | £14,877 - £26,561 |

| Intermediate Rate | 21% | £25,689 - £43,662 | £26,562 - £43,662 |

| Higher Rate | 41% | £43,663 - £150,000 | £43,663 - 75,000 |

| Advanced Rate | 45% | N/A | £75,000 - 125,140 |

| Top Rate | 48% | Above £125,140 | Above £125,140 |

The changes

Everyone paying tax is impacted by these changes although the difference varies with there being very little impact for some. To be clear on everything that is changing;

- The starter rate ends at £144 higher.

- The basic rate ends at £873 higher.

- The Intermediate rate starts at £873 higher.

- The Higher rate end at £75,000 instead of £125,140.

- The advanced rate is a new band introduced in 2024 which is charged at 45%.

- The top rate remains unchanged although 1p is being added to the rate taking it to 48% from 47%.

Who pays tax in Scotland?

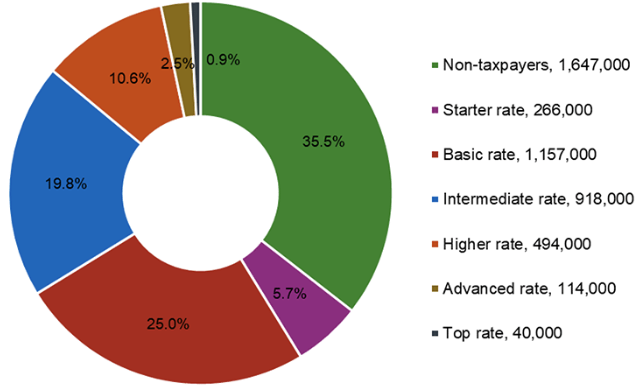

From the Scottish government website, the following chart shows who pays tax. As you can see there are approximately 1.64m non-taxpayers. Around 36% of those who do pay tax are largely unaffected by these changes. I say largely in that the overall changes will impact every taxpayer but those on lower incomes will barely notice it.

Changes to National Insurance

Add to this the reduction in national insurance contributions and many will not even notice it, some will still see a slightly higher net pay going forward.

Only 114,000 of the total 2.989,000 taxpayers in Scotland are expected to fall into the new Advanced rate with only 40,000 in the top rate.

The impact of these changes

According to the Scottish Government, about 36% of taxpayers are not impacted at all by these changes. For those there will likely be a net increase to their take-home pay resulting from the reduction in National Insurance rates starting in January 2024.

These changes are designed to raise more income to plug a gap in government finances due to promises such as freezing Council Tax expected to cost around £300m.

The Fraser of Allander Institute, a research institute at Glasgow University casts doubt on the government's suggestion that they will raise as much as they believe these changes will.

Some Organisations suggest the changes may raise £257m but the Allander Institute states this is based on static behaviour. That is people will simply do nothing and accept the changes to their tax. They believe many people will not do this and make some changes to their income or lifestyle including;

- Pay more to their pension thereby reducing their taxable income.

- No longer renting property to reduce their taxable income.

- Stopping work altogether and retiring.

As a result, the Allander Institute suggest the actual revenue generated by these changes could be as low as £60m. If that turns out to be true the question then needs to be asked, "What does the Scottish government do next?". Time will tell.

I for one will be following this closely.

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

Scottish Rent Cap UpdateOlder Post >>

National Insurance reduced in 2024