Mortgage Protection Insurance

Insurance is a subject that excites nobody. Well unless you are an industry geek like me. whatever your view of insurance it is a necessary part of life.

Planning for the future, most often the unexpected future is key to protecting you and your family should something happen. I am not going to try and guilt-trip anyone or come across as a persistent salesperson desperate to make a commission on a policy sale. But!

Only because I have seen homes lost because someone has lost their job, died or had to give up work due to long term illness, I know how important it is to be protected.

In this guide I am going to look at some key products that will provide you with cover in the event of a number of future unexpected events should they happen. These are:

- Life Insurance

- Critical Illness

- Mortgage Payment Protection

- Income Protection

- Waiver of Premiums

To be clear, lenders do not require that you have any of the above products. They may suggest them to you but cannot insist you take one out. Most will however expect you to have building insurance to protect the property.

Life Insurance

The most common type of mortgage insurance is to protect the borrower or borrowers in the event of death. Within mortgages, this is often referred to as term insurance.

Simply put the policy will pay out on the death of the policyholder within the policy term. The policy term is normally the term of the mortgage, which is why it is referred to as term insurance.

There are three types of term insurance. All are easy to understand.

Decreasing term

The most common choice when combined with a capital repayment mortgage. With this type of mortgage the amount you owe decreases over time.

Take out a mortgage today for £100,000 and that is what you owe on day one. Each month you make a payment some of it goes to reduce the amount borrowed and the rest covers the interest. So after 5 years, the amount owed may be £95,000 then after 10 years £70,000 and so on until the last payment when you owe nothing.

Decreasing term insurance works in line with your mortgage balance. The amount of cover on day one is £100,000, using the example above the cover would reduce to £95,000 after 5 years and reduce further to £70,000 after 10 years. The insurance cover is always the balance of the mortgage.

Upon death, the amount received will cover the outstanding balance of the mortgage, nothing more.

Given the amount of cover is constantly reducing in line with the mortgage balance it makes this type of insurance more cost-efficient than others.

Level term

With level term insurance, the cover stays constant throughout the term of the policy. Assuming the mortgage again starts at £100,000 and the policy remains in place for the entire term of the mortgage then it will pay out £100,000 regardless of the amount outstanding on the mortgage.

This is useful for anyone who has an interest-only mortgage where the amount owed to the lender is the same on the last day as it was on the first day of the mortgage.

It is also beneficial when a borrower has an interest-only mortgage even with a specified repayment strategy. For example, an ISA will be used to repay at the end of the term but if a borrower dies at any point there may not be enough in the ISA and the exact shortfall in the amount due can’t be known.

A common reason for level term insurance is simply to provide the surviving borrower with a lump sum. If one borrower was to die say 15 years into a 25-year mortgage term then the remaining borrower will receive at least £50k as well as have the mortgage repaid.

Level term premiums are generally higher than decreasing term, however, there are two options when it comes to setting the premiums.

- Guaranteed Premiums – Agreed at the start of the mortgage and remain the same throughout.

- Reviewable Premiums – Usually lower than the guaranteed premiums, however, the insurer will carry out regular reviews and may increase them for a variety of reasons such as claims experiences since the last review. They cannot consider the health of the borrower when reviewing premiums.

The amount of cover is determined by you with level term insurance. So if you wanted to have cover of £300,000 when your mortgage is £100,000 that is your choice. The cost of the premiums is the only factor you will need to consider.

Convertible term

Not as common these days but convertible term life insurance is an available option. Think of it this way. You take out a policy for say 5 years. The premiums remain the same throughout the term. Normally at the end of the term, the policy ends and if you want a new one, you simply apply for it. But depending on your circumstances, health and so on, it may be more expensive or you may not be insurable at all if you have serious health issues at that point.

The benefit of this type of cover is in the name, it is convertible. The policy has a conversion option. Assume the policy was originally 5 years and that period is coming to an end. With convertible term insurance, you have the option to convert the cover under your current policy and transfer it into a new, longer-term policy.

When you opt to convert there is no requirement to undergo a medical examination or provide evidence to show you are in good health. Useful, especially if your health has changed and perhaps your life expectancy is known to be within a range of time and you want to ensure you maintain cover.

When converted the insurer can still change the premiums based on age and life expectancy at the time the policy is converted.

Critical Illness Insurance

The name clearly gives this one away. When it first arrived as a product in the 80s it wasn’t really that well received. A lot of people saw it more as a product the insurer would profit from way more than policyholders. Today it is an important type of insurance that has benefitted many.

None of us knows the future, a lot can happen in our lives medically but it does not always result in death. And that is where critical illness insurance can be very helpful.

Imagine the unfortunate position if you have a stroke that leads to permanent symptoms meaning you are unable to return to work. This is the kind of situation where critical illness cover shines. It doesn’t payout when you die, but when you survive a critical illness.

All policies will state what conditions are covered and how long you must survive from the date of diagnosis for the benefit to be paid. Commonly the time for survival is 14-30 days from diagnosis, so not long. There are no further conditions around survival or death.

Imagine another scenario where the policyholder is diagnosed with terminal cancer. The expectation is that the policyholder will live for up to two years. After 30 days the policy will pay out whatever the benefit is and that is that. The policyholder is free to use the money as they see fit.

Many will combine critical illness with a life policy. That way there is comfort in knowing the mortgage will be repaid on death. In the meantime, the benefit received from the critical illness cover can be used to repay other debts, take a dream holiday or simply used to support loved ones.

Every policy is different and coverage of illnesses will differ so you need to check options. The majority of insurers if not all will exclude HIV and AIDS. Importantly those in front line roles such as Police, and medical professionals will be covered for HIV and AIDS if contracted whilst carrying out their normal duties.

If you are applying for cover and have a history of a specific illness covered then you may be declined cover or the costs of premiums could be prohibitive.

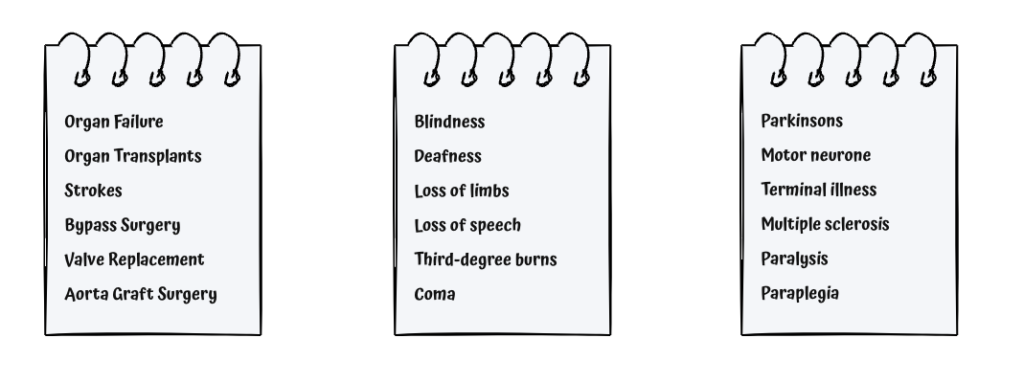

As an example here is what you should reasonably expect all policies to cover. Again always check first!

The Association of Britsh Insurers (ABI) carried out a review of critical illness cover and published new standards. These provided much-needed clarity for policyholders. Changes included the requirement to provide a clear understanding of what the policy does and does not cover. All policies must cover core medical conditions. Valid claims must be paid promptly.

Mortgage Payment Protection Insurance

So far we have looked at the insurance that provides cover in the event of death or critical illness. What about a different situation? One where you are in a position where you can’t make your mortgage payments due to an Accident, Sickness or Unemployment? These were more frequently called ASU policies.

Now they are more often called Mortgage Payment Protection Insurance policies or MPPI. This is more reflective of what they actually are. Unemployment can happen for a number of reasons, in the past, the U in ASU only meant unemployment as a result of forced redundancy when there could be other reasons.

To be clear, there is no life protection here. The benefit is paid as a result of being unable to work. A specified amount will be paid, usually monthly for a period of time, normally up to 2 years.

The cover is available to anyone with a mortgage but age restrictions are likely and usually between 18-65. There should not be a requirement for a medical or a medical questionnaire.

The benefit that can be received is usually restricted and will cover the mortgage payment at the time the claim is made.

There is often the option to receive a higher benefit, up to 25% more appears to be the norm. This is intended for essential costs such as council tax and/or insurance to protect the property. There is no specific requirement as to what that extra benefit is to be used for.

The amount received is paid tax-free.

Deferment period

All policies have a period that is referred to as the deferred period. This is the initial period that must pass before the benefit will begin. usually, the shortest period is 30 days but it can be extended and be up to 2 years before the benefit starts.

The longer the deferment period the cheaper the premiums. But more importantly, many of these types of policies are unlikely to pay out until the policyholder has exhausted any savings or redundancy payments received. So if you expect say £12,000 redundancy and anticipate spending £1,000 per month then there is little point in having a deferred period of 30 days when that will never actually happen.

Exclusions

If you have any pre-existing medical conditions then these will not be covered. Self-inflicted conditions caused by alcohol or drugs will not be covered.

It is likely you will need to have been employed in your current role for a minimum period of time before cover can be provided. If there is any suggestion you were aware of the potential for redundancy when applying then cover may not be provided. If you are unemployed due to something you have done and been dismissed as a result then expect cover will not be provided.

Income Protection Insurance

The final mortgage protection insurance product we are going to look at is income protection.

Income protection is like MPPI above with a distinct difference. MPPI is to protect your mortgage payment, here we are protecting your income, which in part also protects your mortgage payment.

Income protection protects in the event of an accident or sickness. It does not offer any protection against unemployment.

This type of policy used to be referred to as Permanent Health Insurance, the reason for this is that the policyholder can make as many claims as required providing they are valid, the insurer cannot cancel the policy or amend the premiums because of the number of claims.

The policy length can be long, often the standard approach is the anticipated retirement date of the policyholder. Although usually no later than age 70.

Another key difference between this type of policy and MPPI is the term of the benefit. Once a claim is made, whether that be due to an accident or sickness, it will be paid until whichever of these comes first.

- Returning to work

- The end of the policy

- Death of the policyholder

There are options to reduce the benefit period, say two years only. Income protection is not cheap, reducing the benefit period can significantly reduce the premiums.

Level of benefit

Income protection is not designed to replace your entire salary. Insurers don’t want to give you a reason not to return to work! Commonly the benefit will be in the region of 60% of the income being received immediately prior to the claim.

If the policyholder is able to claim state benefits then the value of these will be deducted from the benefit paid.

Where the policyholder could return to work on a part-time basis but on a lower salary the insurer will still pay the difference between the benefit and the part-time salary.

Deferment period

As with MPPI, there will be a deferment period. 13 weeks is common before the benefit is paid.

Waiver of premium

Despite the fact, that you may have lost your job or are unable to work due to illness the premiums for your protection policy still have to be made even after a successful claim. So any benefits you receive will need to cover the ongoing premiums.

The majority of policies offer what is called a waiver of premium option. This simply means that following a successful claim, you will not be required to maintain the premiums.

The downside is that it will affect the premiums, making them slightly higher, although the difference is normally negligible.

Summary

And that covers all I wanted to review in this article. There are options out there to cover most scenarios. It is up to you to decide what if any is important to you and what level of cover you require.

As always it is important you read any policy documentation so that you are clear on what it does or does not include and that meets your needs. Always consult with a professional who can guide you to the right products. Using a registered professional also provides you with a degree of protection vs selecting your own without support.

Hope you found this helpful.

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

Support for Mortgage InterestOlder Post >>

Arrears & Repossession