ClearScore - Free Credit Information

Everyone knows the impact a poor credit score has on getting credit. Many don't check their report at all or leave it until credit is needed before having a look. For many, it's only after applying for credit that an issue is discovered.

So rather than leaving it until it's too late, keep an eye on your report, not because you need credit today, but rather because you may need it one day.

Quite often I hear people say they don't want to pay for a credit report which is why they don't check it. But times have changed, most agencies now offer free checks. One in particular that I recommend as I have used it for many years is ClearScore.

What is ClearScore?

A free service that you can sign up for in just a few minutes with no cost, no card required and no commitment of any kind. Although they do offer some services you will need to pay for, none are required unless you choose to.

To be clear, the sign-up process simply requires you to provide your basic personal details and addresses for the last 3 years. From that, it can find any information held on your record and it will ask you a series of questions to confirm it's you and not someone else. Once you get past those there is nothing more to it.

What does ClearScore offer?

You will get a credit score based on a maximum of 1000. The image at the top is taken from my credit score, as you can see it's 925/1000. This is based on various factors, the higher it is the more positive factors can be seen. Positive factors can include elements such as:

Having a permanent address

Being registered on the voter roll

Having credit (seems obvious but having no credit is a negative)

Not having more than 30% of credit card or store card balances outstanding

No missed payments

Not having too many credit/store cards or loans

Paying at least 10% of credit/store card balances each month rather than the minimum

ClearScore is an independent service that receives its information from Equifax. They are not the only credit agency in the UK. There is also Experian and Transunion.

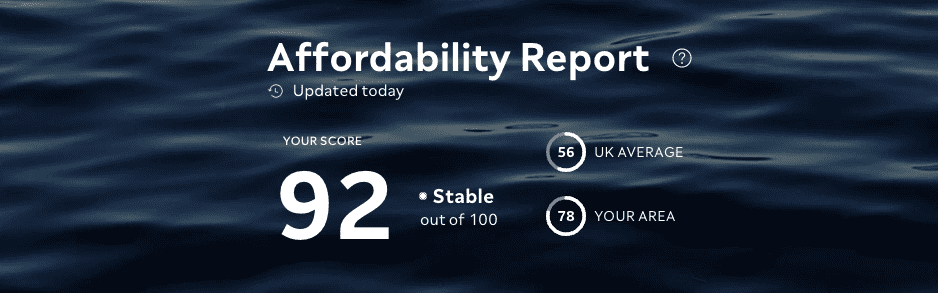

Affordability Report

In addition to a credit score they also offer an affordability score. This is more a nice to have although they claim the information helps to get you better deals and a higher acceptance chance for credit.

For this to work well it does require that you link your bank accounts so that they can see your day-to-day banking, confirm incoming salary amounts, regular outgoings and so on.

I Will say that since I have used the affordability report I have seen better offers through ClearScore than I was getting before.

Giving access to ClearScore and in fact, any company to your bank accounts is done through Open Banking. This is very secure and only allows them to view information, nobody but you can interact with your accounts. Open Banking is regulated by the FCA and covered by the Data Protection Act.

How does ClearScore make money?

A common question. Giving you a free service, how do they make money? That is quite easy. Part of their service is to provide each customer with a search facility to look for a variety of credit products and link your credit score to them giving an idea of how likely you will be accepted. Products they can offer include:

Credit Cards

Loans including car finance

Car Insurance

Current and savings accounts

Mortgages

Energy

If you take out any of the above through ClearScore they get a commission. They also get a fee if you click through to partner websites seen on their site. They have services that you can pay for. that they offer A £4.99 fee for daily updates and fraud protection. Normally your credit score is updated weekly.

They are very profitable and now serve 17m customers in the UK, Australia, Canada and South Africa. Their revenue in 2020 was £44m and they employed 450.

Why ClearScore may not be the best option

As noted above there are 3 main agencies in the UK.

Equifax

Experian

Transunion

None of these agencies can function without data flowing into them. Essentially what happens is that credit providers must send these agencies data on their customers each month to get access to all the information that the agency holds.

For example, banks send one or more agencies a file each month telling the agency what products their clients have and whether they paid on time that month. In return, they get access to the information every other company sends that agency. They use that information to make lending decisions.

The issue you could have with ClearScore is that they only receive information from Equifax. So if you have credit with a company that only sends data to Experian then you won't see that information on ClearScore.

In the UK it's fair to say that all banks and credit providers favour Equifax and in most cases send data to more than one agency. So it's likely everything will be available on ClearScore although not impossible that it could be missing.

CheckMyFile

An alternative to ClearScore is CheckMyFile. It provides a report that covers Equifax, Experian and Transunion. Useful if there is a time when a provider is suggesting they cannot lend because of something that you can't see through a different service. Check out their service here.

Summary

Keeping on top of your Credit Search is important. Even if you don't need credit today, you may need it tomorrow. For most a good credit report is assumed simply by knowing they don't have arrears. It's not always that simple.

As noted above there are many factors which can impact your score. Having many accounts even if up to date on payments may be a factor that ends up preventing more credit in the future or the inability to have a good rate.

Through ClearScore you only need to log in once a month or even once every couple of months. Just to make sure what you think is true. And if it's not you can take action.

Have a look, it costs nothing. ClearScore.

Lee Wisener, CeMAP, CeRER, CeFAP

Having worked in the mortgage industry for over 20 years I have always wanted to build a website dedicated to the subject. Also being a geek when it comes to the internet all I needed was time and I could both build the site from scratch and fill it with content. This is it!

<< Newer Post

Mortgage Underwriter – a role for you?Older Post >>

Is this the end of leasehold, again?